▶

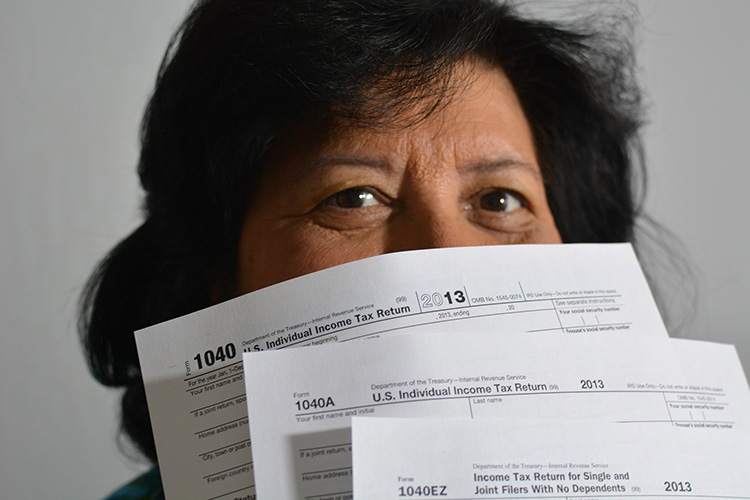

~Individual Taxes~

Individual Taxes are due April 15th of every year and you have the responsibility to file your tax returns. If you file an extension, your tax return is due October 15th. If you owe the IRS your payment is due April 15th

▶

~Corporation Taxes~

Corporation Tax Return is due on March 15th of every year. If an extension is filed the return is due September 15th. If your corporation tax return is not filed by March 15th and no extension was done, the penalty is $195.00 per shareholder per month.

▶

~Non-Profit or 501(C)3 Organization~

Non-Profit or 501(C)3 Tax Return is due by May 15th of every year. If an extension is filed the extension is for 3 months and is due by August 15th.